Wazzup Pilipinas!

Pioneering event by global property website Lamudi features solutions to the country’s widening housing backlog

Increasing the government’s available funds for financing the low-cost housing segment was one of the ways to meet the housing backlog that Atty. Christopher Ryan Tan, former president of the Organization of Socialized Housing Developers of the Philippines (OSHDP) and CEO of housing developer Hausland Development Corporation, gave at The Outlook by Lamudi.

The Outlook by Lamudi: The First Event of Its Kind in the Philippines

The Outlook was the launch of global property platform Lamudi’s comprehensive report on the country’s real estate industry, which involved a nationwide survey of 10,000 Filipino property seekers from across the country to complete. This event coincided with a coming-together of the industry’s thought leaders.

Held at the Marquis Events Place in Bonifacio Global City (BGC) on November 29, the event brought together top-level industry representatives, including real estate players specializing in mixed-use or township developments, leaders of organizations advocating more cohesive, comprehensive and affordable housing programs, and key officials from the public sector, to discuss what’s next for the industry, backed by real consumer data gathered by Lamudi. Among the topics discussed were trends in mixed-use developments, the evolution of residential condominiums across the country, the details that go into building new cities, provincial expansion and its significance, the importance of building green and the housing backlog.

The Housing Backlog: A Closer Look

Citing a government study, Atty. Tan noted that the country’s housing deficit is estimated to reach a staggering 7.67 million by 2022. “In other words, in the eyes of the government, that’s how many households would direly need housing provision or housing units. And that is a huge number,” he said.

Given the government’s peg of the housing shortfall, Atty. Tan is aware of the daunting task ahead both for the private and the public sectors, especially since according to him, there’s only an actual production of less than 200,000 housing units annually for the past five years. “It’s somewhere between 168,000 and 190,000 a year,” he approximated, “so when you do the math, considering that population grows, it seems that you would not be able to catch up. So that’s really a huge problem.”

The battle, however, is not yet lost, assured Tan. “That’s the challenge now: How really to meet the housing need, and to be able to do that, you need to produce on the lower end.”

Homes not valued more than Php3 million are classified as affordable housing in the country. Government agency Housing and Urban Development Coordinating Council (HUDCC) outlined the bracketing for the low-income segment based on price range and ceiling. In its categorization, units sold for more than Php1.7 million but not exceeding Php3 million are considered low-cost housing. Those that sell for Php450,000 up to Php1.7 million are classified as economic housing, while homes under the socialized housing group are those with a selling price below Php450,000.

Together, these three groups comprise the low-income market, which, according to Atty. Tan, eats up the lion’s share of the country’s residential market in terms of production.

“That is the majority in terms of the number of units,” he explained, “but when you look at it in terms of the value or in terms of prices, it’s the reverse. You would find that the much expensive housing units, in terms of value, when you convert the total amount of loans generated by the housing sectors, majority are still cornered by the high-end.”

In the country, living spaces with a price range of Php3 million up to Php6 million are labeled mid-cost. Those that are sold for more are tagged as high-end. While these units enjoy a positive response from banks in terms of loans, Atty. Tan says it’s not the same for the lower income segments, especially those under socialized housing.

“The toughest, really, is in the socialized housing segment, or those housing units not sold more than Php450,000,” he lamented, “because not many banks would be willing to lend at this level. The reason for that is, this segment is perceived to be the least capable of paying and the highest risk.

“But that is the greatest need if you ask me where production has to be accelerated. So it seems that both ends don’t meet.”

This, for Atty. Tan, poses one major challenge for the government: “We need the government to come in because if private banks would be hesitant to provide financing for the low-end market, the government’s role, really, is to increase available funds for financing for that segment.”

Get Lamudi’s The Outlook report on January 2018 to read the rest of Atty. Tan’s solutions to the housing backlog—and more.

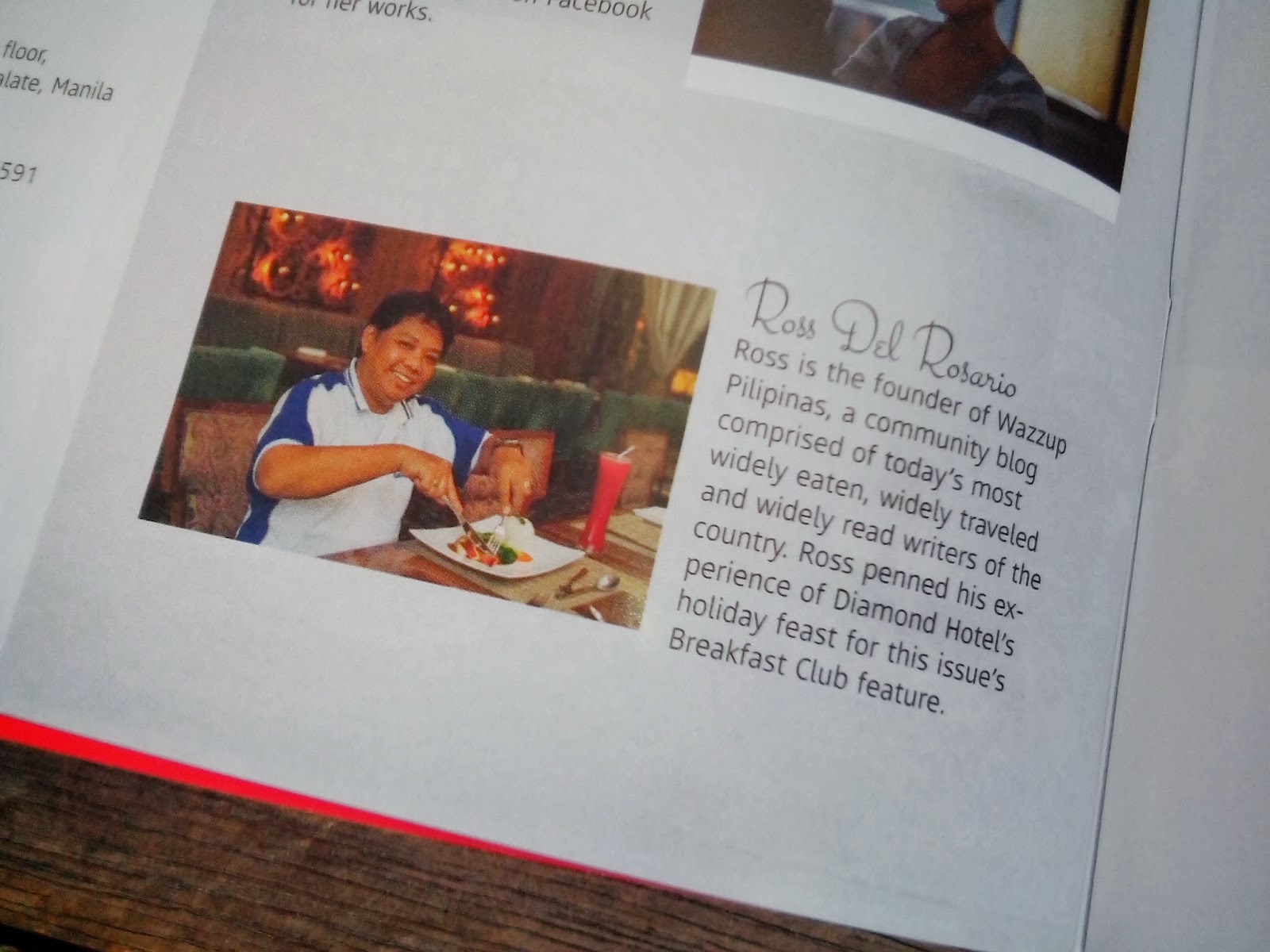

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.

Ross is known as the Pambansang Blogger ng Pilipinas - An Information and Communication Technology (ICT) Professional by profession and a Social Media Evangelist by heart.